Recycled Polypropylene Packaging Market 2025 Statistics, Global Valuation and Regional Trends

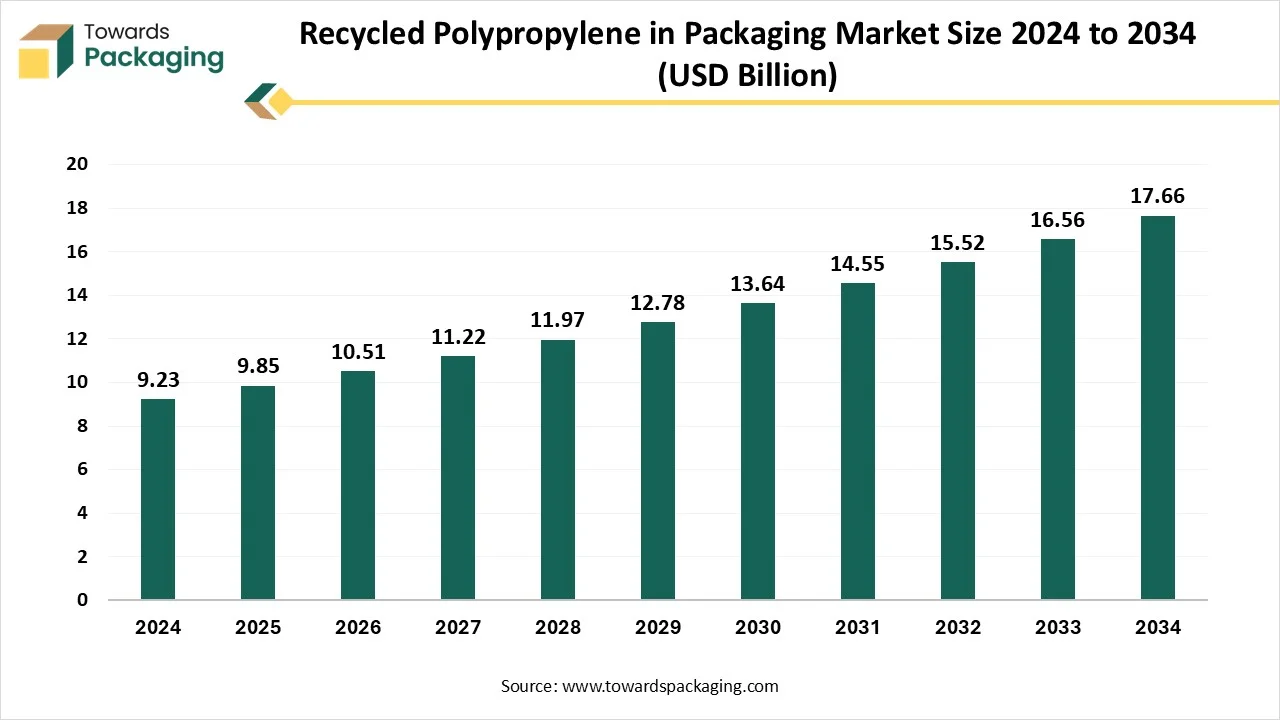

As reported by Towards Packaging experts, the global recycled polypropylene in packaging market is anticipated to rise from USD 9.23 billion in 2024 to approximately USD 17.66 billion by 2034, with a CAGR of 6.73% from 2025 to 2034.

Ottawa, July 24, 2025 (GLOBE NEWSWIRE) -- The global recycled polypropylene in packaging market size was recorded at USD 9.85 billion in 2025 and is forecast to increase to USD 17.66 billion in 2034, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5650

The market is gaining momentum due to increasing environmental concerns, rising demand for sustainable materials, and growing government regulations on plastic waste. Recycled polypropylene is widely used in rigid and flexible packaging applications, especially in food, beverage, personal care, and household products, due to its durability, chemical resistance, and recyclability.

The circular economy initiatives adopted by manufacturers and retailers are also propelling the use of rPP. Additionally, advancements in recycling technologies have improved the quality and consistency of recycled polypropylene, making it more suitable for high-performance packaging needs and reducing reliance on virgin plastics.

What is Recycled Polypropylene in Packaging?

Recycled polypropylene (rPP) in packaging refers to the reuse of post-consumer or post-industrial polypropylene plastic waste to produce new packaging materials. Polypropylene is a versatile thermoplastic polymer widely used in packaging due to its lightweight, toughness, and resistance to chemicals and moisture. Instead of being discarded, used polypropylene products such as containers, caps, films, and automotive parts are collected, sorted, cleaned, and reprocessed into reusable pellets through mechanical or chemical recycling processes. These recycled materials are then used to manufacture new packaging solutions, including rigid containers, trays, bottles, and flexible films.

The use of rPP helps reduce the environmental impact of plastic waste, conserve resources, and lower carbon emissions associated with virgin plastic production. Moreover, it supports the principles of the circular economy by promoting sustainable material usage and waste reduction. With growing demand for eco-friendly and cost-effective packaging, recycled polypropylene is becoming a preferred material across various industries, including food, personal care, and consumer goods.

Explore Strategic Figures & Forecasts – Access the Databook Now: https://www.towardspackaging.com/download-databook/5650

What Are the Key Trends Shaping the Recycled Polypropylene in Packaging Market?

-

Advancements in Recycling Technologies

Innovations in chemical recycling, such as depolymerization and pyrolysis, are enabling the conversion of contaminated or multilayer polypropylene into near-virgin quality resin. This breakthrough supports expanded use of recycled PP in demanding applications like food-grade packaging, flexible films, and automotive parts.

-

AI-Driven Sorting & Quality Control

Automated sorting tools using AI and NIR spectroscopy are boosting rPP purity and reducing contamination. This improves output consistency, lowers waste, and makes recycled polypropylene suitable for food and personal care packaging.

-

Expansion into High‑Spec Packaging

Brands like Procter & Gamble have officially approved chemical-grade rPP resins (e.g., PureFive) for precision components such as caps and high-performance BOPP films. These applications demonstrate that rPP can perform on par with virgin materials in structure and aesthetics.

-

Strong Circular Economy & Regulatory Drivers

Extended Producer Responsibility (EPR) policies and corporate sustainability targets (e.g., pledges to include 30–50% recycled content by 2030) are pushing demand. This is particularly evident in regions like Europe, North America, and Asia-Pacific.

-

Flexible‑to‑Rigid Packaging Shift

Flexible rPP formats (films, wraps, pouches) lead current usage due to their versatility. However, the rigid packaging segment (bottles, containers, caps) is projected to grow rapidly, driven by demand in the food, personal care, and household goods sectors.

-

Supply‑chain Integration & Infrastructure Scaling

Major players like LyondellBasell, Borealis, TOMRA, and Berry Global are collaborating to build infrastructure (mechanical and chemical recycling plants), enabling closed-loop systems and traceable recycled feedstock sourcing.

-

Consumer Sentiment & Brand Risk

Consumers, particularly in North America and Europe, are increasingly rejecting products due to unsustainable packaging. Alcohol and personal care brands face reputational risk unless they visibly embrace recycled content and recyclable formats.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is the Opportunity for the Growth of the Recycled Polypropylene in Packaging Market?

-

Environmental Regulations and Sustainability Goals

Governments worldwide are enforcing strict regulations on plastic usage and waste management, such as bans on single-use plastics and mandates for recycled content in packaging. These rules encourage manufacturers to adopt recycled materials like rPP to comply with sustainability standards and reduce landfill waste.

-

Corporate Sustainability Commitments

Leading consumer goods companies are pledging to include a minimum percentage of recycled content in their packaging to meet ESG (Environmental, Social, and Governance) goals. Recycled polypropylene is often favored due to its balance of durability, performance, and environmental benefits.

- In January 2025, in India, the ministry in charge of policies governing sustainable development and environmental preservation is called the MoEFCC. In a notification dated January 23, 2025, the MoEFCC introduced strict steps to alter the Plastic Waste Management Rules, 2016. It guarantees improved accountability, traceability, and adherence to the laws and guidelines governing the handling of plastic trash.

- Support for Circular Economy Models

Recycled polypropylene supports the circular economy by extending the lifecycle of plastics. Many industries are actively investing in closed-loop systems to recover, recycle, and reuse polypropylene materials, reducing dependency on virgin plastics.

-

Global Increase in Plastic Waste Generation

The mounting volume of plastic waste has intensified the need for effective recycling solutions. Polypropylene, being one of the most commonly used plastics, represents a significant opportunity for recycling and reuse in packaging applications.

- Global plastic garbage production is expected to exceed 460 million tonnes per year by 2025. Fifty-one trillion microplastics and 25 trillion macroplastics are included in this. Every year, plastic waste kills 100,000 marine animals and more than a million seabirds.

Limitations & Challenges in the Recycled Polypropylene in Packaging Market:

Limited Recycling Infrastructure & Quality and Contamination Issues

The key players operating in the market are facing issues due to limited acceptance in food packaging as well as limited recycling infrastructure, which may restrict the growth of the market. In many developing regions, there is inadequate infrastructure for collecting, sorting, and processing polypropylene waste. This results in lower recovery rates and inconsistent supply of high-quality rPP, making it difficult for manufacturers to scale their use in packaging. Recycled polypropylene often faces challenges related to contamination from food, labels, or other materials. Mechanical recycling can degrade the polymer’s properties, leading to variations in strength, color, and odor. These issues restrict its use in high-performance or food-grade applications.

More Insights of Towards Packaging:

- Recycled Materials Packaging Solutions Market - The global recycled materials packaging solutions market is forecast to grow from USD 205 billion in 2025 to USD 331.96 billion by 2034, driven by a CAGR of 5.5%.

- Custom Sustainable Boxes for E-Commerce Market - The custom sustainable boxes for the e-commerce market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Recycled Packaging for Apparel Market - The recycled packaging for the apparel market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Recycled Polyethylene Terephthalate Market - The recycled polyethylene terephthalate market is set to grow from USD 12.76 billion in 2025 to USD 26.78 billion by 2034.

- PVC Packaging Film Market - The polyvinyl chloride packaging film market is projected to reach USD 17.48 billion by 2034, growing from USD 14.06 billion in 2025, at a CAGR of 2.43% .

- Post-Consumer Recycled Plastic Market - The post-consumer recycled plastic market is expected to increase from USD 13.06 billion in 2025 to USD 31.91 billion by 2034, growing at a CAGR of 10.44%.

- Uncoated Recycled Paperboard Market - The uncoated recycled paperboard market is projected to reach USD 30.59 billion by 2034, growing from USD 20.97 billion in 2025, at a CAGR of 4.3% .

- Recycle Ready Retort Pouches Market - The recycle ready retort pouches market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- Recycled PET Bottles Market - The recycled PET bottles market is set to grow from USD 2.67 billion in 2025 to USD 6.16 billion by 2034, with an expected CAGR of 9.74% over the forecast period from 2025 to 2034.

- Recycled Glass Market - The global recycled glass market is set to expand from USD 4.27 billion in 2024 to USD 7.71 billion by 2034, growing at a CAGR of 6.09% from 2025 to 2034.

-

Recycled Aluminum Cans Market - The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7%.

Regional Analysis:

Who is the leader in the Recycled Polypropylene in Packaging Market?

North America dominates the recycled polypropylene in packaging market due to its well-established recycling infrastructure, strong regulatory framework, and increasing consumer awareness about sustainable packaging. The region’s emphasis on circular economy practices and corporate sustainability commitments by major brands has accelerated the demand for rPP in various packaging applications.

The presence of leading packaging and recycling companies, along with government initiatives promoting the use of recycled content, further supports market growth. Additionally, technological advancements in mechanical and chemical recycling enhance the quality and performance of rPP, making it a viable substitute for virgin plastics across diverse packaging segments.

U.S. Market Trends

The U.S. leads the North American rPP packaging market due to its robust recycling infrastructure, advanced technologies, and strong presence of packaging manufacturers and consumer goods companies. Federal and state-level regulations, such as minimum recycled content mandates and Extended Producer Responsibility (EPR) laws, are pushing industries toward sustainable packaging. Major brands, such as Coca-Cola and Unilever, have made commitments to incorporate recycled content, thereby boosting rPP demand. Additionally, innovations in chemical recycling are expanding the applications of food-grade rPP.

Canada Market Trends

Canada is experiencing steady growth in the rPP packaging market, driven by strong environmental policies and public pressure for sustainable packaging solutions. Government targets for zero plastic waste by 2030 and initiatives like the Canada-wide Action Plan on Zero Plastic Waste encourage the adoption of recycled materials. Provincial EPR programs and increasing investment in recycling infrastructure are improving access to high-quality rPP, especially for use in rigid containers and personal care packaging.

How is the Opportunistic Rise of the Asia Pacific in the Recycled Polypropylene in Packaging Market?

Asia Pacific is experiencing the fastest growth in the recycled polypropylene in packaging market due to rapid industrialization, expanding urban populations, and increasing environmental awareness. Governments in countries like China, India, Japan, and South Korea are implementing stricter waste management policies and promoting the use of recycled materials to combat plastic pollution. Additionally, the region’s large consumer base drives demand for packaged goods, prompting manufacturers to adopt cost-effective and sustainable packaging solutions like rPP.

Investments in recycling infrastructure and technological advancements, especially in mechanical and chemical recycling, are further enhancing the availability and quality of recycled polypropylene. Moreover, the presence of numerous packaging, plastic, and consumer goods manufacturers in the region supports large-scale adoption. Rising participation in global sustainability initiatives and corporate commitments to circular economy practices also contribute to the region's rapid growth in the rPP packaging market.

China Market Trends

China is a major driver of growth in the Asia-Pacific rPP packaging market due to its large-scale manufacturing capacity, government-backed plastic recycling policies, and growing investments in circular economy initiatives. The country is modernizing its recycling infrastructure and implementing strict plastic waste management laws, such as bans on non-degradable plastics and requirements for recycled content in packaging. Domestic demand for consumer products and e-commerce packaging further supports rPP usage.

India Market Trends

India is rapidly emerging as a significant market for rPP in packaging, fueled by rising environmental concerns, regulatory actions like the Plastic Waste Management Rules, and increased awareness among consumers and manufacturers. The government’s push for sustainability, along with expanding urbanization and retail growth, is driving demand for cost-effective, recycled packaging solutions. Investments in sorting and recycling technologies are also improving the quality and availability of rPP.

Japan Market Trends

Japan’s strong environmental policies and highly efficient waste management system make it a notable market for recycled polypropylene. The country emphasizes resource efficiency and supports recycling through extended producer responsibility schemes. Japanese packaging companies are focused on innovation and often incorporate rPP in food, personal care, and household product packaging as part of their sustainability commitments.

South Korea Market Trends

South Korea’s government has implemented aggressive recycling targets and plastic reduction initiatives, encouraging businesses to shift toward sustainable packaging materials. With high public awareness and participation in recycling programs, rPP is being increasingly used in both rigid and flexible packaging formats. Strong support for eco-friendly technologies and innovation is aiding market growth.

Australia Market Trends

Australia’s recycled polypropylene market is growing steadily, driven by national commitments to reduce plastic waste and increase recycled content in packaging by 2025. Federal initiatives like the National Plastics Plan and investment in advanced recycling infrastructure are making high-quality rPP more accessible. Brand-level sustainability goals also support the shift to recycled packaging.

How Big is the Success of the Europe Recycled Polypropylene in Packaging Market?

Europe is witnessing notable growth in the recycled polypropylene in packaging market due to its stringent environmental regulations, strong circular economy policies, and high consumer awareness of sustainability. The European Union’s directives, such as the Single-Use Plastics Directive and the Packaging and Packaging Waste Regulation (PPWR), mandate increased use of recycled content and reduction of virgin plastic consumption. These policies drive manufacturers to adopt rPP in both rigid and flexible packaging applications.

Europe's well-developed recycling infrastructure and advancements in chemical and mechanical recycling technologies ensure a consistent supply and quality of recycled polypropylene. Many European brands and retailers have committed to using sustainable packaging, further boosting rPP demand. Public and private investments in recycling innovation and eco-friendly packaging solutions are also contributing to market growth. The region’s collaborative approach among governments, industry players, and consumers makes Europe a key growth hub for rPP in the global packaging industry.

How Crucial is the Role of Latin America in Recycled Polypropylene in Packaging Market?

Latin America is experiencing considerable growth in the recycled polypropylene in packaging market due to increasing awareness of plastic pollution, rising environmental regulations, and growing demand for sustainable packaging solutions. Countries such as Brazil, Mexico, and Argentina are implementing initiatives to improve plastic waste management and promote recycling practices. The expansion of consumer goods and retail industries in the region is driving the demand for cost-effective and eco-friendly packaging materials like rPP.

Multinational companies operating in Latin America are aligning with global sustainability goals, encouraging the use of recycled content in packaging. While infrastructure challenges remain, ongoing investments in recycling facilities, public-private partnerships, and educational campaigns are gradually strengthening the region’s capacity to support circular economy practices and drive rPP adoption.

How does the Middle East and Africa lead the Recycled Polypropylene in Packaging Market?

The Middle East and Africa hold strong potential for growth in the recycled polypropylene in packaging market due to rising environmental awareness, regulatory developments, and increased demand for sustainable packaging solutions. Governments in the region are beginning to implement stricter waste management policies and restrictions on single-use plastics, encouraging the use of recycled materials. Countries like South Africa and Saudi Arabia are making notable progress, with South Africa improving its recycling infrastructure and Saudi Arabia supporting green initiatives through public-private partnerships.

The growing industrial activity, urbanization, and consumer preference for eco-friendly products are fueling demand for rPP in both rigid and flexible packaging formats. Although recycling infrastructure is still developing in parts of the region, ongoing investments, educational campaigns, and support from global sustainability programs are paving the way for increased adoption of recycled polypropylene in the packaging sector across the Middle East and Africa.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Packaging Type Insights

Flexible packaging is the dominant packaging type in the recycled polypropylene packaging market due to several key factors. First, flexible packaging offers significant material efficiency, using less plastic than rigid alternatives while maintaining product protection, making it highly attractive for sustainability-focused brands. Second, its lightweight nature reduces transportation costs and carbon emissions, aligning with environmental goals.

Third, flexible formats such as pouches, wraps, and sachets are widely used across industries like food, personal care, and pharmaceuticals, driving high demand. Additionally, advancements in recycling technologies now allow for better incorporation of recycled polypropylene into flexible formats without compromising quality, strength, or functionality. These factors collectively reinforce flexible packaging's dominance in the rPP packaging market.

Rigid packaging is the fastest-growing packaging-type segment in the recycled polypropylene packaging market due to increasing demand for durable, reusable, and recyclable packaging solutions, especially in food, beverage, and household product sectors. Its superior structural integrity makes it ideal for containers, bottles, caps, and trays that require product protection and extended shelf life.

The growing adoption of post-consumer recycled polypropylene in manufacturing rigid formats is further driven by regulatory pushes for circular economy practices and brand commitments to sustainability. Additionally, advancements in mechanical and chemical recycling technologies have improved the quality of recycled PP, enabling its use in rigid applications without compromising performance, thereby accelerating growth in this segment.

End Use Insights

The food and beverage industry is the dominant end-use industry in the recycled polypropylene packaging market due to its high consumption of packaging materials for items like containers, caps, trays, and films. This sector demands packaging that ensures food safety, product freshness, and extended shelf-life qualities that recycled polypropylene can provide when processed under strict standards.

The growing consumer preference for sustainable and eco-friendly packaging has pushed food and beverage brands to adopt rPP solutions. Moreover, regulatory pressure to reduce plastic waste and meet recycling targets has encouraged manufacturers to integrate recycled materials. The versatility, durability, and cost-effectiveness of rPP make it especially suitable for the diverse and large-scale packaging needs of this industry.

The personal care and cosmetics segment is the fastest-growing end-use segment in the recycled polypropylene packaging market due to increasing consumer demand for sustainable beauty products and eco-friendly packaging solutions. As awareness of environmental issues rises, consumers are favouring brands that use recycled materials, prompting many cosmetic companies to adopt rPP in their packaging.

Major brands such as L'Oréal and L’Occitane have made strong sustainability pledges, aiming to incorporate significant amounts of recycled content into their packaging lines. Recycled polypropylene offers excellent compatibility with aesthetic and functional needs, such as color customization, molding, and premium finishing, making it ideal for beauty containers and closures.

Advancements in recycling technology have also improved the quality and safety of rPP, enabling its broader use in personal care applications. Furthermore, many consumers are willing to pay more for sustainably packaged products, giving brands an incentive to invest in rPP solutions. These factors collectively drive the segment’s rapid growth.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Market:

- In June 2025, senior officials from a number of organizations, including the Department of Chemicals & Petrochemicals, BIS, FSSAI, Reliance Industries Limited, Tata Consumer Products, Dabur India Limited, Nestlé India Limited, Jubilant FoodWorks Limited, Coco-Cola India, PepsiCo India Holdings Pvt. Ltd., Tops, Mars India, and Flex Limited, convened to exchange ideas, discuss obstacles, and coordinate future steps.

- In March 2025, leading global chemical company LyondellBasell today announced the introduction of Pro-fax EP649U, a novel polypropylene impact copolymer intended for the rigid packaging market. This cutting-edge product is perfect for food packaging applications because it is specially made for thin-walled injection molding.

- In January 2025, Antalis, a leading international B2B distributor of papers, packaging, and visual communication products and services, introduced Priplak R30, a line of colored and white polypropylene with 30% post-industrial recycled content that may be used for point-of-sale displays, labels, packaging, and other applications.

Top Companies in the Recycled Polypropylene in Packaging Market

- Mitsubishi Chemical

- ECOPLAS (HK) LIMITED

- Pashupati Group of Industries

- Formosa Plastics

- Banyan Nation

- Sumitomo Chemical Co., Ltd.

- Berry Global Inc.

- Exxon Mobil Corporation

Recycled Polypropylene in Packaging Market Segments

Packaging Type

- Flexible Packaging

- Rigid Packaging

End Use

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Household Products

- Industrial Goods

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5650

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Web Wire | Packaging Web Wire | Automotive Web Wire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.